Rules of Engagement of Galvestone Forex Trading System :

1. The range of your last few high/low points is more than 20 pips. High/Low points on our charts are indicated by the red (high) and blue (low) circles. (also called “Mouteki 2 bar high/low points”) These are a high or low point with two bars on each side of them that didn’t make a new high or new low. We don’t use all red and blue circles when deciding if 20+ pips has been reached, we mainly use the points that have shown very little retracement. The exception to this rule is only if your potential trade is in the direction of the overall trend. If so, less than a 20 pip range could still be acceptable, provided the other variables match.

2. Trade the right side of the range. If you are planning to go long, your entry would be in the bottom half of the range between your last few high/low points-closer to the low of the range. When shorting a currency, it would be the top end of the range. If you are in the direction of the overall trend then this rule is less important.

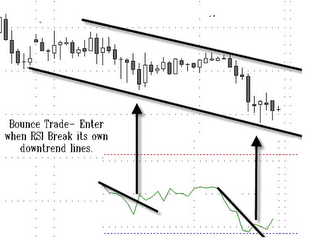

3. Before placing a trade, wait for a breakthrough of any decent support or resistance that’s nearby. Ideally, we like to see double confirmations. If there is a break of the trend line, we like to wait for a break of the nearest support or resistance as well. We do this to avoid reversing our position on what is likely a small retracement. On our chart we have two examples of this. The first trade breaks the trend line followed by a breakthrough of the resistance. The second trade breaks through the support and then the trend line. During the upward move, we also have retracements that break the trend line, but not the support line, therefore we never reversed our trade.

4. Draw smooth trend lines-use clean points with no previous breakthrough. This is important because we think that once the price passes through it, the integrity of the trend line has been weakened. Once a price breaks through our trend line, we modify our trend line according to the previous break. We take our original point and use the high or low of the violation bar as our next point. We then draw a trend line between the old line and the new line, because we would still consider entering that trade on a double confirmation. If the trend line is strong, and the price pulls away from it, only to come back and pass through it, we don’t need a double confirmation. We would consider entering the trade without it, if there are no support or resistance points in the area around the breakthrough.

5. If our trade is going really well, and the trend line looks pretty steep, we often change our strategy a little. We would not be looking to stop and reverse as usual, but be more concerned with not giving back all of our profits. If your price targets have been reached or you feel you are coming up on a strong support or resistance, then feel free to exit the trade. We like to give the trade a chance, usually waiting for a trend line violation or an opposite support or resistance break though. Sometimes there will be no mouteki price points or trend lines in the immediate area, so we look for technical reversal points to exit our trades with still a decent profit while at the same time giving our trade room to breathe.

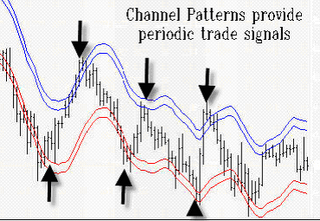

6. Be conservative on choppy days or days when bars have consistent long shadows. The Forex usually follows some daily pattern, until, of course, it is broken. Because of that some days will be very easy to trade and profitable, and others will be difficult. For the most part the market will be fairly easy to trade and profit from because of the very large daily pip range. The sooner we recognize the type of market we are in the sooner we can adapt our trading strategy to it. One way we can “adapt” is by utilizing smaller stops when the market is trending tightly, and using better positioned stops when the market is more volatile. If we see a ranging market, then we can look to enter on a single confirmation closer to the top or bottom the range. It is easy to trade according to rules, however it is more difficult to recognize and adapt to the current market conditions. By using adaptive rules we can better play specific market conditions.

7. Use technical points for stops. There is no need to risk more than 15 pips on a trade when using a 5 minute chart. If you decide the risk is worth the reward then virtually any stop can be justified, but be aware of the next major support or resistance, as that will likely be your first target or obstacle. Ideally, our stops will be on the opposite side of the top/bottom range point nearest to our trade. If this is not possible then we will try and place our stops just beyond the nearest support or resistance levels that we can find that are within reason. Remember to add your spread (2 pips) and a buffer zone (1-3 pips) to the support or resistance you chose to put your stop behind. The basic idea is that our trades have 3 possible scenarios, 2 of them going our way. The trade could move against us and break out past our technical point; we lose. The trade could move against us, hit our technical point and reverse back, moving our way; we win. The trade could move in our direction; we win.

8. Managing stops can be the biggest determinate between making money and losing money. If we trail our trade tightly, we increase the chance of making a small profit, but reduce the likeliness of making a big profit. Small profits are good, however, if we consistently get stopped out at +5 or so, and are willing to risk 15 pips on the downside, it will be tough to make decent money. More often than not we would miss the big runs. With that said, we need to be intelligent about our stops, both in placing them as well as managing them. Ideally, we just close our trade and take a position the other way. If we are using a trailing stop loss, we need to keep our distance and always place stops behind strong support/resistance points. We trail our stops if we think our stop is in a weak position. The stronger we feel our stop is, the less likely we are to move it (unless the trade moves into good profit.) One strategy that makes stops easier to manage is trading two lots. The first lot we look to exit at the first likely reversal point, thereby locking in profit, (or at least offsetting any potential moves that stop you out.) Trading two positions can free you up mentally by satisfying your need for locked in profits, but also allowing you an opportunity to see your trade run as well.

9. Trading bigger ranges and trading with the overall trend will reduce your risk and dramatically increase the probability of a successful trade. Like we stated earlier trading two or more positions also increases your chance of success. Remember that the trend is more likely to continue than it is to reverse.

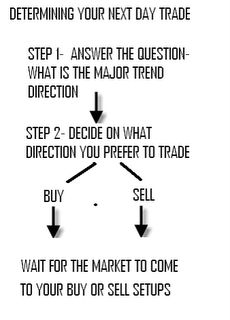

10. Do not force or create trades. Wait for the market to dictate when you trade. This rule is the difference between following a strategy and “just winging it”. Modifications can be great, but entering early, really late, or placing large stop losses are recipes for disaster if not thought through.

These Rules of Engagement are based on the results of one lot trading with a few adaptive variables, (e.g. stops and limits.) We have NOT tested trading only with the trend, or trading only large movements. Refer to our recent chart example for a better idea of our strategy.

Additional Information:

Additional Information:Q: When using a 5 minute chart are we not just giving spreads to our broker?

A: That depends on the currency pair. For the EUR/USD, our spread is around 1.5-3 pips, which is a fraction of our allowed stop loss. We want to position ourselves for the larger moves, but even with smaller moves we can overcome a 2-3 pip spread easily. We don’t enjoy paying a spread, but it is a factor that most intraday trading strategies must deal with and overcome.

Q: Why use such a small chart; wouldn’t the 15 or 30 min be better?

A: The 5 minute chart is both the 15 and the 30 minute chart it’s just a matter of how you look at it. Three 5 minute bars are a 15 minute bar, and six 5 minute bars are a 30 minute bar. The 15-30-60 minute charts can’t tell you about a 5 minute chart, and a 5 minute chart can tell you what the 15/30/60 minute charts tell you. That’s why we use it.

Q: Why don’t you use any technical indicators along with your charts?

A: We would be happy to if you know some that would correlate with the strategy that we are trading, and that would act as a confirmation of when to enter or exit a trade. We are trying to keep trading relatively simple; “if this, then that”

Q: Why do you use trend lines along with supports and resistance points?

A: Trend lines give us a glimpse of the possible future, and supports and resistances open or close certain actions within that possible future. The idea isn’t to use a moving average to tell us what we already know; rather the point is to gather information on what we don’t currently know and using that information to predict probable directions of the market.

Final Note:

The point and goal of all of this is to simply make pips, individually and collectively. How we get to that point doesn’t matter, what does is that we make it there. Please test, tweak, develop, and create towards our goal of group success. It is difficult to put onto paper a set of rules that work, because often the market gives us hints on what’s going to happen and opportunities that we could seize but our rules don’t allow for us to do it. It is for that reason that we are working on two other strategies to fill the voids that this one leaves. Our other strategies in progress are for trading supports & resistances and trading range breakouts. You will see that sometimes we miss big trades because we followed our rules, so utilizing multiple strategies just makes sense. We will revise and update these strategy rules in the near future, but for now, please look over this strategy. Test it. Modify it. Do whatever you wish with it! We look forward to any constructive criticism or suggestions or how to make it better. Feel free to stop by our group site or shoot us an email. Thank you for taking the time to read this, have a fantastic Holiday and we wish you the best of luck in 2007.

Galveston ,-

Near where the orange arrows are pointing are examples of valleys, and blue arrows point to peaks. The arrows are a bit inaccurate, but it’s the best I can do so bear with me. One could probably set a minimum wave size in terms of pips to determine whether or not a peak or valley would be “major”.

Near where the orange arrows are pointing are examples of valleys, and blue arrows point to peaks. The arrows are a bit inaccurate, but it’s the best I can do so bear with me. One could probably set a minimum wave size in terms of pips to determine whether or not a peak or valley would be “major”.

As you may or may not see, the pending BUY order I had placed earlier has now been triggered. As I woke up this morning and checked my chart, I realized that I had missed a long opportunity denoted at the green arrow. I also moved my S/L to the next valley just after the green arrow pointing to the peak, AND put in a short order for when/if my S/L is hit. This to me is a sign that the current trend has stopped producing higher high’s and low’s, and MAY be headed south instead.

As you may or may not see, the pending BUY order I had placed earlier has now been triggered. As I woke up this morning and checked my chart, I realized that I had missed a long opportunity denoted at the green arrow. I also moved my S/L to the next valley just after the green arrow pointing to the peak, AND put in a short order for when/if my S/L is hit. This to me is a sign that the current trend has stopped producing higher high’s and low’s, and MAY be headed south instead. Near where the orange arrows are pointing are examples of valleys, and blue arrows point to peaks. The arrows are a bit inaccurate, but it’s the best I can do so bear with me. One could probably set a minimum wave size in terms of pips to determine whether or not a peak or valley would be “major”.

Near where the orange arrows are pointing are examples of valleys, and blue arrows point to peaks. The arrows are a bit inaccurate, but it’s the best I can do so bear with me. One could probably set a minimum wave size in terms of pips to determine whether or not a peak or valley would be “major”.

As you may or may not see, the pending BUY order I had placed earlier has now been triggered. As I woke up this morning and checked my chart, I realized that I had missed a long opportunity denoted at the green arrow. I also moved my S/L to the next valley just after the green arrow pointing to the peak, AND put in a short order for when/if my S/L is hit. This to me is a sign that the current trend has stopped producing higher high’s and low’s, and MAY be headed south instead.

As you may or may not see, the pending BUY order I had placed earlier has now been triggered. As I woke up this morning and checked my chart, I realized that I had missed a long opportunity denoted at the green arrow. I also moved my S/L to the next valley just after the green arrow pointing to the peak, AND put in a short order for when/if my S/L is hit. This to me is a sign that the current trend has stopped producing higher high’s and low’s, and MAY be headed south instead.