This forex trading strategy which is great for people who work full time but want to build a very lucrative part time forex trading addiction into full time profession from the comforts of their job:

1. 30 Min chart

2. 5 Period SMA

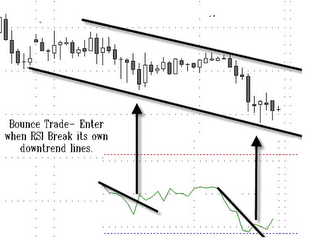

3. 45 RSI

4. 21 Average True Range (This is a volatility metrics to help determine lot size)

5. Use a 50 PIP stop.

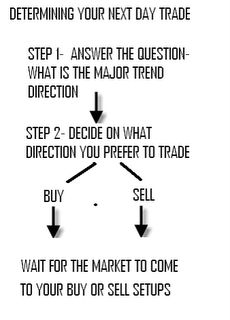

Get Long (buy) position when the price exceeds the SMA by 5 PIPS for the first time and the RSI is greater than 50. Get Short (sell) position when the price fall below the SMA by 5 pips for the first time and the RSI is less than 50. The target for this system is always 200 PIPs (which I am currently enjoying with the GBP/USD).

Example:

The ATR is used to determine lot size. Lot size or Money Management is by far the most important concept to trading.

Happy Trading,

Tkimble (from ForexFactory.com)

1. 30 Min chart

2. 5 Period SMA

3. 45 RSI

4. 21 Average True Range (This is a volatility metrics to help determine lot size)

5. Use a 50 PIP stop.

Get Long (buy) position when the price exceeds the SMA by 5 PIPS for the first time and the RSI is greater than 50. Get Short (sell) position when the price fall below the SMA by 5 pips for the first time and the RSI is less than 50. The target for this system is always 200 PIPs (which I am currently enjoying with the GBP/USD).

Example:

The ATR is used to determine lot size. Lot size or Money Management is by far the most important concept to trading.

Happy Trading,

Tkimble (from ForexFactory.com)