The Bladerunner forex strategy is a price action trading so it using tools like candlesticks, pivot points, round numbers and support and resistance levels when trading this strategy. But you can add more indicators if you think that they're useful or you feel more comfortable having some extra confirmation.

In this article we use the 20 EMA for confirmation indicator. Another alternative is to use the midline of the standard 20 Bollinger bands. Either works well, in fact you can use both to trade it as a Bollinger band EMA strategy.

The Bladerunner forex strategyp can be traded on any pair. It can also be traded on any time frame, but the examples below are from 5 min charts.

It can be traded at almost any time of the day, but obviously some times are more reliable than others. For example, the early part of the Asian session may provide a decent break out and retest giving an entry, whereas the Asian afternoon session can be very slow. Then, when London opens the price may be too erratic and volatile to give any reasonable entries for any strategy.

Later again, after the initial flurry of news announcements has passed and price has settled, you may once more get a reliable entry or two. You will therefore have to adjust this strategy to the times when you are able to trade it.

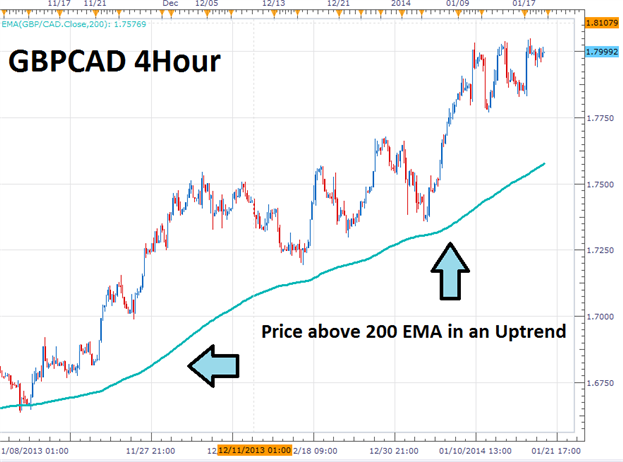

The strategy is named Bladerunner because the 20 EMA acts like a knife edge dividing price. If price is above the EMA, and respecting it, and retests the EMA, it will likely reject to the long side. And if price is below the EMA, and respecting it, and retests the EMA, it will likely reject to the short side. A few examples might help to clarify:

If price is below the 20 EMA, our bias is short and we would be looking for price to move up and hit the 20 EMA, reject and then move down.

However, if price pierces the 20 EMA and closes convincingly above it, we deem price to have switched polarity and now our bias changes to long. (This can be seen occurring at the right of the above picture). From now on we would be looking for price to move down and hit the 20 EMA, reject and then move up.

An example of one definite and one possible losing trade:

Essential entry parameters for this setup are:- Price must break out of consolidation or a range prior to entry, i.e. it must be trending

- Price must then retest the 20 EMA successfully

What constitutes a successful retest? If price is above the EMA it must bounce from and stay above the EMA; and vice versa for when price is below the EMA. More specifically: The first candle that touches the EMA should close on the same side of the EMA as it approached it from.

This then becomes the signal candle. Price has now rejected from the EMA and we are looking to see if the next candle confirms the move. If the next candle continues the move away from the EMA then this candle becomes the confirmatory candle. This is a simple way to trade the strategy; if you want to play it safer you could insist on a recognisable forex candlestick pattern occurring to confirm the trade.

n.b. if the Bladerunner seems simplistic, it is because forex price action and current fundamentals are factored into trading decisions. No entry is ever taken based purely on price having rejected from the 20 EMA.

Impotant Notes:- Always look for a confluence of reasons to enter the trade. For example, it’s safer to have more than just a rejection from the 20 EMA. Ideally, you would like to see this happening at the same place as an old support/resistance level, pivot level or other significant price impact point.

- Always be on the lookout for impending news announcements when trading this setup, especially on the lower time frame charts. I generally will not enter any trade within 30 to 45 mins before a scheduled news event, and will always wait at least 15 mins after the event before considering a trade.

- Always trade with the direction of the current trend, as determined by which side of the EMA or polarity indicator price is currently on.

Order Placement:(Note: the following parameters call for spreading your entry across two orders, but nowadays I have found that it is simpler for me to just enter one position/order per trade. However, many traders prefer to have their trade split across two positions, as this enables them more flexibility in their exits.)

A suggested approach is to open 2 orders when trading this strategy. The orders are as follows:

For a long entry:- 2 buy stop orders are placed with entry 2 pips above the confirmatory candle.

- Orders expire at the start of a new candle. For example, if entering limit orders on the five-minute chart, those orders will expire at the start of the next five-minute candle, unless they have already been filled by price action on the current five-minute candle.

- The stop loss is placed 2 pips below the signal candle that touched the 20 EMA. This particular rule is not set in stone, you may place the stop behind a recent swing point if you believe that would give a more realistic stop size.

- The take profit for the first order is set at an amount equivalent to the risk in pips. For example, if the risk in the trade is 20 pips, the first order’s take profit target will be set at 20 pips.

- The take profit for the second order is set at an amount equivalent to double the risk in pips. So, to use the above example, the take profit on the second order would be set at 40 pips.

For a short entry: - 2 sell stop orders are placed with entry 2 pips below the confirmatory candle.

- Orders expire at the start of a new candle. For example, if entering limit orders on the five-minute chart, those orders will expire at the start of the next five-minute candle, unless they have already been filled by price action on the current five-minute candle.

- The stop loss is placed 2 pips above the signal candle that touched the 20 EMA. This particular rule is not set in stone, I may place the stop behind a recent swing point if I believe that would give a more realistic stop size.

- The take profit for the first order is set at an amount equivalent to the risk in pips. For example, if the risk in the trade is 20 pips, the first order’s take profit target will be set at 20 pips.

- The take profit for the second order is set at an amount equivalent to double the risk in pips. So, to use the above example, the take profit on the second order would be set at 40 pips.

Trailing stop:Once price has moved in favour of the trade by an amount equivalent to the initial risk, one of the orders is closed (due to its reaching take profit 1 level) and the stop loss on the remaining order is moved to breakeven. Using the above examples, once price moves 20 pips in favour of the trade, the first order is closed and the stop loss on the remaining order is set to breakeven.

This remaining order’s stop is then left at breakeven until the market closes the trade, either by reaching the profit target or by stopping out at breakeven. Again, this rule is not set in stone: there may be times when you may wish to continue trailing the stop beyond breakeven, for example, when a news announcement is imminent.